Fine Wine & Inflation: Investment Amidst Economic Uncertainty

Fine wine proves its worth as inflation rises

The UK inflation rate unexpectedly increased to 4% in December. It parked a sharp sell-off in gilts. Many traders lowered expectations about when the Bank of England would begin reducing interest rates.

Today we examine the possible advantages of investing in fine wine during difficult times.

CPI and inflation

The UK Consumer Price Index (CPI) hit 4% in December 2023. It was the first increase for 10 months. Driven by increase in alcohol and tobacco prices, this reading exceeded the 3.8% forecast by City's economists.

The CPI reflects the prices of a basket of consumer goods and services known as 'normal goods', such as transportation, food, and medical treatment. According to many economists, these normal goods have no potential investment worth during times of inflation.

By contrast, several asset classes perform well in inflationary environments. For example, real estate, gold and the stock market are often popular inflation-hedging investments options.

How does inflation impact fine wine?

Fine wines are usually considered as 'Luxury Goods'. They are the opposite of necessity goods as they tend to be sensitive to a person's income or wealth. In other words, as one's wealth rises, they purchase more luxury items. As inflation continues to rise, one would think that the performance of luxury goods would decline.

However, as corporations strive to keep wages up-to-date with inflation, luxury goods are also seeing increased demand. For example, the French luxury group LVMH saw a 14% growth in the first 9 months of 2023, despite disappointing Chinese openings and a drop in U.S. sales.

Fine wine is a combination of investment and luxury goods. It has ‘an active secondary market' and it has ‘scarcity' as part of its nature. As such, it tends to perform well during times of uncertainty and inflation.

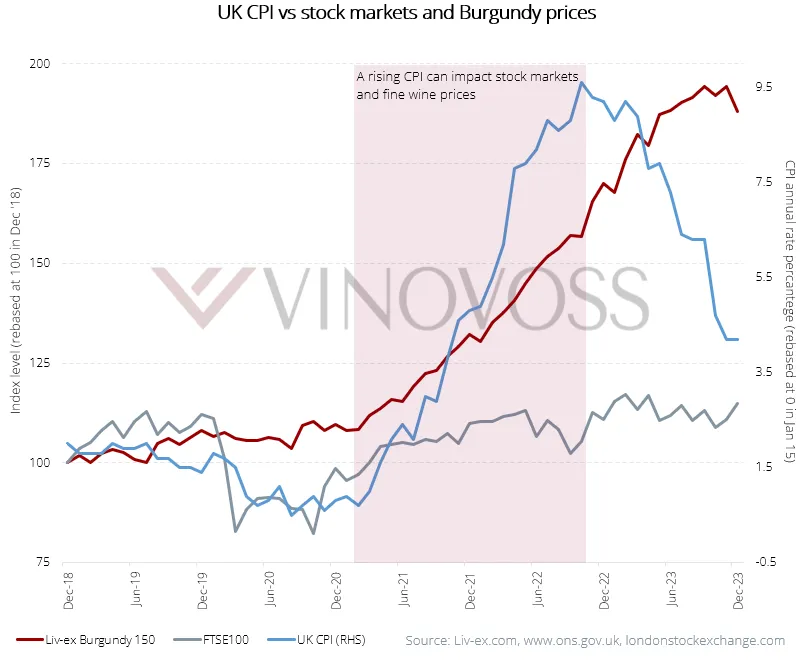

The chart below compares fine wine, stock and housing investments to the CPI. As displayed, the performance of the Liv-ex Burgundy 150 mirrors the pattern of CPI, rather than stocks (FTSE100).

In summary, with the UK inflation unexpectedly increasing, fine wine becomes a popular investment option. It displays resilience amid economic uncertainties.

By Krystal Wen