- Wine Color/Type

- Top Occasions

- Unique Wines

- Surprise Me!

A Gentle Descent for French Wine and Spirits Exports in 2023

The French wine and spirits industry weathered a tumultuous year in 2023, securing exports totaling €16.2 billion. This represents a 5.9% drop from the year before, yet it remains the second highest export value on record for the sector. Export volumes experienced a significant decrease of 10.4%. Despite these challenges, the industry continued to be a leading force in France's agricultural food surplus and stood as the third biggest contributor to the country's trade surplus, achieving a €14.8 billion trade surplus, a 5.8% decline from the previous year.

Challenging times require creative solutions. (Comugnero Silvana/stock.adobe.com)

The year 2023 was marked by global instability, including ongoing international conflicts and significant inflationary pressures. Gabriel Picard, the President of the French Association of Wine and Spirits Exporters (FEVS), pointed out the industry's robustness in such difficult times, celebrating the second highest export total as a considerable achievement under the circumstances.

Varied Outcomes

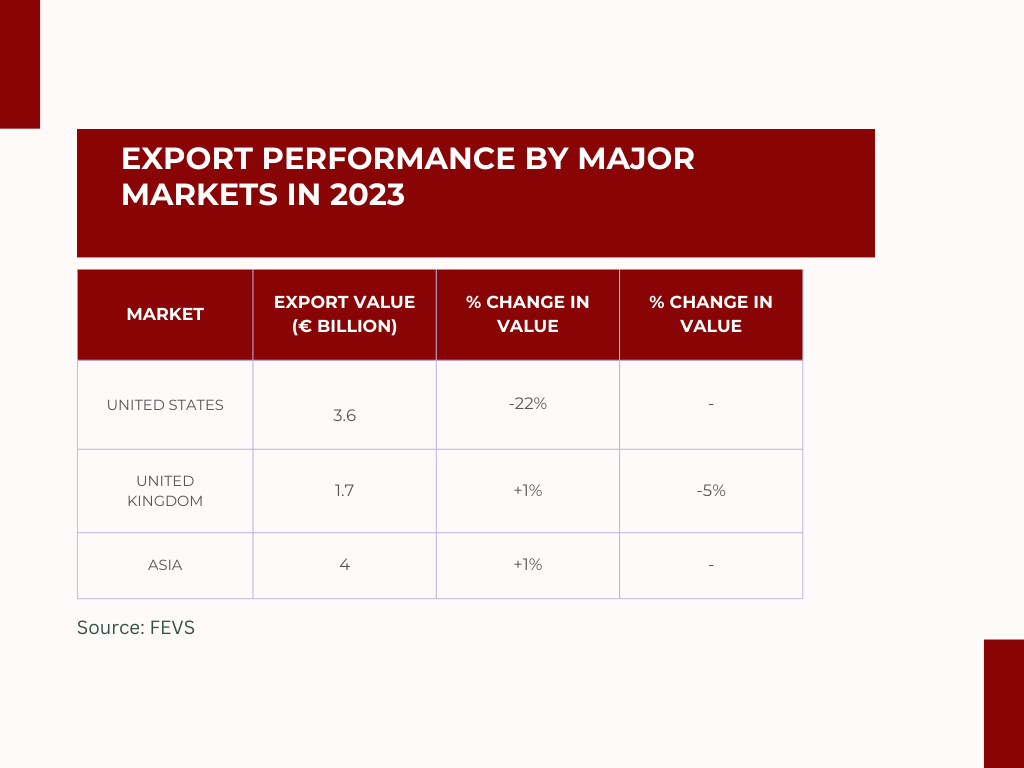

Analyzing specific markets, the results were varied. The United States saw a sharp decrease in exports by 22% to €3.6 billion, mainly due to distributors reducing inventories built up during the Covid-19 pandemic and facing further logistical hurdles. The decline was stark in the spirits segment, which dropped by 37%, and in sparkling wines, which saw a 16% decrease. Nevertheless, still wines managed to maintain their value. Towards 2023's end, there were indications of a potential upswing in this vital market.

The UK market was relatively stable, with a slight 1% uptick in export value to €1.7 billion. The demand for both sparkling and still wines remained consistent, despite a 5% fall in volume. Spirits saw a modest value increase of 2%, with a slight volume decrease of 1%.

In Asia, the picture was mixed, with total exports amounting to €4 billion, a 1% rise. Japan experienced a 4% decrease, while South Korea and Taiwan's markets were stable. China presented a diverse picture: while spirits, especially Cognac, grew by 3%, wine values plummeted by 20%, mirroring a 21% decrease in Chinese wine imports. Emerging markets like Malaysia and the Philippines displayed significant growth from a smaller base, with increases of 20% and 74% respectively, amounting to €100 million for both countries.

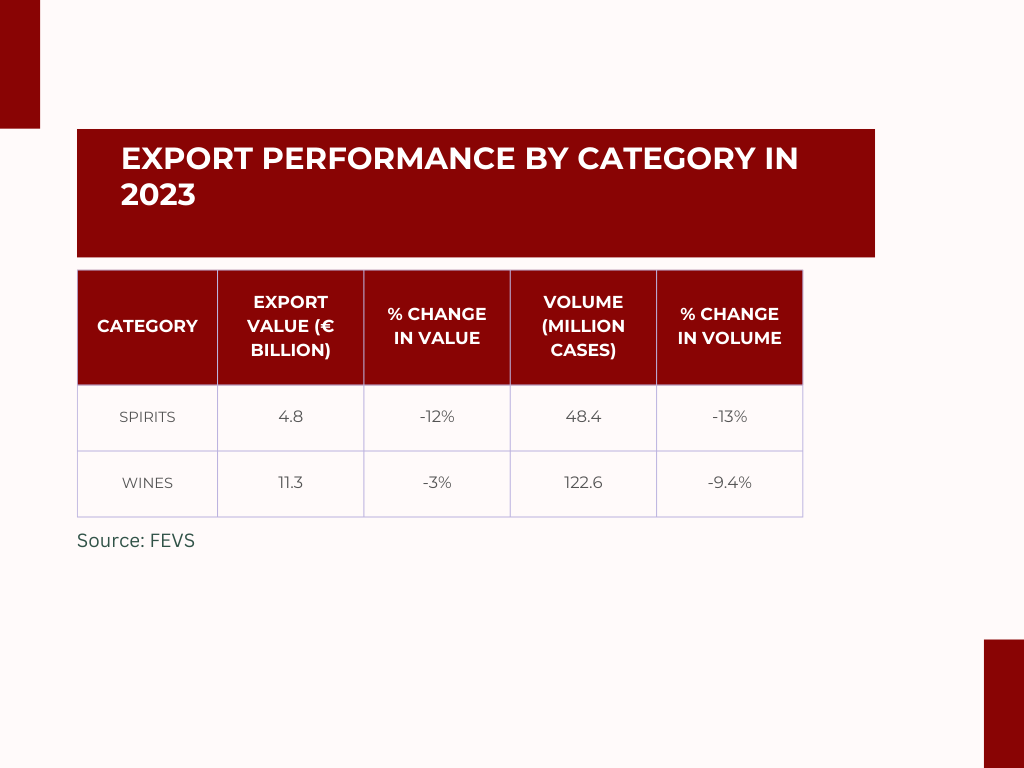

The sale of French spirits globally suffered a 12% decrease to €4.8 billion, with volume falling by 13%. Wine exports were slightly more resilient, dropping by 3% to €11.3 billion, with a 9.4% decrease in volume.

What does this mean for French wine and spirits?

Picard emphasized that the sector's struggles in 2023 were intensified by high inflation and a decrease in consumption due to lower disposable incomes. The reduction in exports, particularly in volume, was partly attributed to the effort to deplete excess stock in several markets, especially the US.

The decline in 2023 is a vital reminder for exporters to stay flexible and attuned to changing consumer behaviors and market conditions. Picard advocated for ongoing government support to ensure the continued success of French wine and spirit exports, including opening new markets and protecting against trade retaliatory actions. He argued that the robustness of France's export sector is key to the nation's sovereignty, highlighting the importance of a global footprint for the wine and spirits industry.

2023 was a year of recalibration for the French wine and spirits sector, underscoring the industry's durability and the necessity for strategic agility. The FEVS's analysis offers a detailed examination of the hurdles and prospects facing exporters, shedding light on the strategies for navigating a dynamic global environment.

As the sector aims to recover from 2023's modest downturn, focusing on market diversification, aligning with consumer preferences, and securing strong support frameworks will be essential for bolstering and advancing France's esteemed status in the worldwide wine and spirits marketplace.

Peter Douglas

Source: French Association of Wine and Spirits Exporters (FEVS)

Latest articles