How COVID-19 Changed the Way We Buy Fine Wine

Last week, we explored how the pandemic reshaped sparkling wine consumption, from Prosecco's dominance to the rise of local bubbles like English sparkling wine (Link for the article).

This week, we focus on fine wine. This category is known for its luxury and exclusivity. However, it has also faced significant changes because of COVID-19 and economic uncertainty.

The fine wine market has faced a unique set of challenges in recent years. The combination of scarcity, an active secondary market, and its status as a tangible asset with intrinsic value has helped fine wine weather economic storms better than many other asset classes.

Here, we highlight the three key takeaways from this article:

- Fine wine’s resilience as both a luxury product and an investment vehicle continues to attract buyers and investors.

- Market transformation is evident in declining prices, shifting consumer habits, and evolving investment strategies.

- Scarcity and intrinsic value position fine wine as a compelling asset in turbulent economic times.

1. Fine Wine as a Hedge Against Economic Uncertainty

Historically, fine wine has shown an ability to retain value during periods of inflation and economic volatility. As highlighted in the January report on Fine Wine & Inflation, the Liv-ex Burgundy 150 Index demonstrated a strong correlation with the UK Consumer Price Index (CPI), reflecting its ability to track inflation trends.

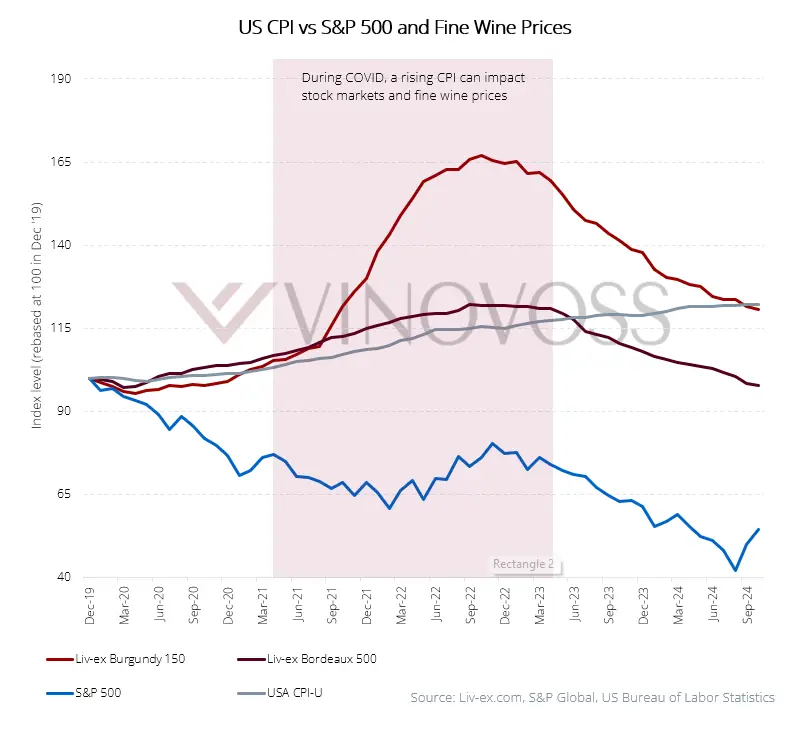

We compared two wine indices: the Liv-ex Bordeaux 500 and the Burgundy 150. We also looked at the S&P 500 and the US Consumer Price Index (CPI-U).

Unlike stocks, which can drop sharply during market instability, fine wine shows more stability. Burgundy prices gained 20.5%, while Bordeaux wine had a small loss of 2.1% over five years. In contrast, the S&P 500 index suffered a 45.6% loss in the same period.

Key Takeaways:

- Intrinsic Scarcity: Fine wine is produced in limited quantities and cannot be reproduced.

- Luxury Appeal: Like other high-end goods, fine wine benefits from aspirational consumer demand.

- Diversification: Fine wine is a unique asset that does not move with stocks, bonds, or real estate. It helps investors balance their portfolios.

2. Fine Wine in Decline but Adapting

COVID-19 accelerated changes in the fine wine market, including a marked decline in prices since 2022.

During the pandemic, lockdowns redirected disposable income toward luxury home experiences, boosting demand for high-quality wine. With restaurants closed, off-premises and secondary markets grew. Collectors looked for fine wine to enjoy and invest in during uncertain times.

The Wine Cap Q3 2024 Fine Wine Report shows that average fine wine prices fell by 4% last quarter. Bordeaux saw the biggest drop at 4.4%. Yet, amidst this downturn, there are pockets of resilience. Champagne showed a modest 0.4% increase in value, and certain brands, like Krug Vintage Brut 2004, recorded significant gains (+21.6% year-to-date).

Key Takeaways:

- Average fine wine prices fell by 4% in Q3 2024, led by Bordeaux (-4.4%).

- Champagne defied the trend, with a slight value increase (+0.4%).

- Despite challenges, steady demand suggests a potential market recovery ahead.

3. Premiumization and the Bordeaux En Primeur Evolution

Bordeaux, historically a cornerstone of the fine wine market, has faced mounting pressure to adapt. Since June 2024, the 2023 Bordeaux En Primeur campaign saw price reductions averaging 27.4% in its opening week, reported by Liv-ex. Some releases provided great value, but the overall market slowdown has affected Bordeaux's growth. Prices have dropped 12% in the last two years.

However, Bordeaux's ability to adapt has shown promise. Famous wines like Lafite Rothschild and Cheval Blanc showed strong demand at good prices. This suggests that fine wine buyers still appreciate classic vintages when sellers price them well.

Key Takeaways:

- Bordeaux En Primeur prices dropped significantly, with discounts of up to 40%.

- Top-performing wines, like Lafite Rothschild and Cheval Blanc, highlighted the importance of competitive pricing.

- Bordeaux’s market share has dropped from 60% in 2018 to 40% in 2023, reflecting the need for greater agility in a competitive market.

4. Shifting Consumer Preferences in the US

In the US, Millennials are reshaping the fine wine market. This age group, with its disposable income and adventurous palate, is driving premiumization by focusing on quality over quantity.

The fine wine market has seen some declines. However, Millennials are trying new styles. They are also willing to spend more on unique, high-quality wines.

According to Euromonitor International, US consumers are embracing fine wine for casual and everyday drinking occasions, rather than reserving it solely for celebrations. This trend aligns with a broader shift towards viewing wine as a versatile choice rather than a luxury indulgence.

Key Takeaways:

- Millennials are leading the premiumization of fine wine in the US.

- Fine wine is becoming more popular for casual and everyday occasions.

- The market has seen declining brand loyalty, creating opportunities for new entrants.

5. Pockets of Stability and New Opportunities

Fine wine combines luxury and investment appeal, making it a strong choice in good and bad economies. Liv-ex shows that the Italy 100 Index, which tracks top Italian wines, has done better than other regions. It has only dropped 2.1% in the first half of 2024.

Tuscany accounts for almost 10% of the total trade value. Super Tuscans, such as Sassicaia and Tignanello, are the most popular.

Trade in other regions has also increased. Spain is becoming popular, with more demand for Vega Sicilia's wines. Their trade value and volume have tripled since the second half of 2023.

Older Bordeaux vintages have remained stable. The Bordeaux Legends 40 Index saw a small increase of 0.3% in June.

Strong Performing Fine wines:

Despite declining prices in certain areas, fine wine remains a compelling choice for strategic investors. The presence of robust platforms ensures liquidity, while inflation resilience and growing global demand underscore its enduring appeal. As central banks lower interest rates, the current market dip is a great chance for long-term investments in fine wine. In an evolving landscape, fine wine continues to thrive, balancing enjoyment, tradition, and financial security.

A Comprehensive Look

The COVID-19 pandemic reshaped the global wine market, transforming how consumers engage with wine across various settings and categories. In our four-part series, we explored these changes, uncovering trends that have redefined the wine industry.

Here are the links to the previous series:

Overall, the pandemic accelerated trends like premiumization, experimentation, and online engagement, fundamentally altering how consumers purchase and perceive wine. As the industry adapts, these shifts will continue to shape the future of wine buying.

Krystal Wen