How COVID-19 Changed the Way We Buy Wine On-Premises

Last week, we examined the transformation in our wine purchasing habits for domestic use because of COVID-19. We focused on the growth of local shops, higher-quality options, and sustainable choices in wine purchases. (Link for the previous article) This week, we shift our focus to on-premises wine—what we drink at restaurants, bars, and hotels.

Here, we highlight the three key takeaways from this article:

- Restaurants have been leading the recovery of wine sales, turning wine into a crucial part of dining experiences;

- Premiumization continues to drive growth, with consumers favoring higher-quality wines over volume;

- Pubs and bars are struggling to restore their wine sales to pre-pandemic levels. They need to find new ways to make wine more attractive to customers.

1. A Tough Road to Recovery for On-Premises Wine

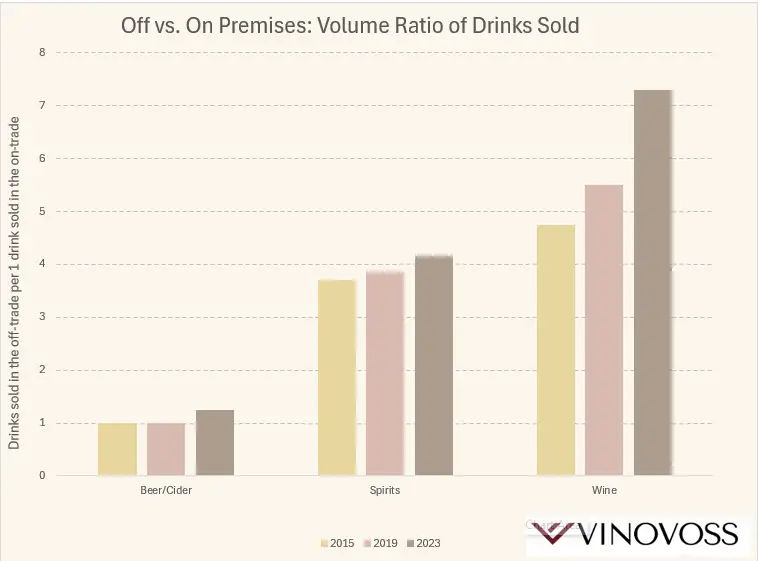

Before COVID-19, the on-premises wine market was already facing headwinds, with wine sales gradually declining as health-conscious consumers drank less. The pandemic further accelerated this shift, as lockdowns forced wine consumption into the off-trade (wine bought for at-home use). Nielsen data shows that, in the UK market, wine sales in restaurants, hotels, and bars reached 93% of pre-pandemic levels by 2023. However, wine sales have not recovered as quickly as beer and spirits.

Despite this slower comeback, premium on-premises wine sales have shown resilience. Increased spending per bottle has compensated for volume declines, as customers gravitate toward better-quality wines. Euromonitor International emphasizes that in the US market, wine has evolved into a luxurious selection for intimate, festive get-togethers. Customers are spending more on high-end bottles to enrich their culinary experiences.

2. Restaurants Lead the Way in Wine Sales Recovery

Restaurants have been the shining stars of on-premises wine recovery. Nielsen data reveals that by 2023, UK restaurant wine sales not only rebounded to pre-COVID levels but also outperformed overall alcohol sales, particularly in the premium segment. The success comes from the carefully chosen wine menus and expert pairings that restaurants offer. This suggests that wine plays a significant role in the meal experience.

Euromonitor reports that, in the US, after the pandemic, people view dining out as a chance to treat themselves. This makes premium wine a great choice. Instead of big celebrations, diners are choosing smaller, intimate events. High-quality wine enhances the feeling of indulgence.

Many restaurants have embraced this trend by creating wine lists that meet these higher expectations. They offer a variety of options that make customers feel special.

3. Bars and Pubs Face Bigger Challenges

While restaurants have thrived, bars and pubs have faced a tougher road. Nielsen data shows that, in the UK, these venues recovered 90% of their alcohol sales from before the pandemic by 2023. Nonetheless, wine sales remain at a reduced level. Beer and cocktails often dominate in these settings, with wine seen as less of a go-to choice for casual socializing.

To change this, bars and pubs need to rethink how they present wine. Euromonitor's insights show that simple actions can improve the wine experience. Making wine lists more visible, offering tastings, and using better glassware are effective steps.

Bars and pubs can take inspiration from restaurants. They can highlight premium offerings. This creates an environment where wine feels exciting. Wine can be just as accessible as a craft cocktail or a pint of beer.

4. Hotels Find Their Niche with Wine

Hotels, on the other hand, have seen a strong recovery in wine sales, fueled by a mix of domestic tourism and premium experiences.

Nielsen data shows that by 2023, UK hotel wine sales were a bit higher than before the pandemic. Still wine did especially well. However, sparkling wine has had a hard time recovering. This is likely because large events, like weddings and conferences, are returning slowly.

Hotels have successfully positioned wine as part of their overall guest experience, offering premium wines by the glass and pairing them with local cuisines. This matches Euromonitor's findings that post-pandemic consumers appreciate unique and indulgent experiences. Wine is a great choice for creating memorable stays.

5. Shifts in Preferences and Premiumization

Not only did COVID-19 alter the locations where we consume wine, but it also impacted our choice of wine. Premiumization has been a key trend, with consumers opting for fewer but higher-quality bottles.

Nielsen data shows that, in the UK, spending per bottle has gone up since the pandemic. Rosé has become a top choice, especially in restaurants. Now, the only type of wine that has grown in volume since 2019 is this one. This growth shows that people enjoy rosé as a versatile and refreshing option.

Red wine, however, has seen a significant decline in on-premises settings, while white wine has remained more stable. Euromonitor says this is due to changes in dining habits in the US. People are enjoying lighter foods and trying new flavors. This has increased interest in different grape varieties and styles.

Wrapping It Up

COVID-19 fundamentally reshaped the on-premises wine market. Restaurants have become leaders in recovery, emphasizing the role of wine in creating elevated dining experiences. Hotels have leaned into premium offerings to delight guests, while bars and pubs are still finding their footing in boosting wine sales. Across all venues, premiumization remains the driving force as customers drink less but spend more on high-quality wines.

In the next article of this series, we will look at sparkling wines and champagne. We will explore how these drinks have changed since the pandemic and gained consumer interest. Stay tuned for more!

Krystal Wen