- Wine Color/Type

- Top Occasions

- Unique Wines

- Surprise Me!

Why Fine Wine Emerges as a Stable Investment

Navigating Financial Turbulence in 2024 - Investment beyond the stock market

In an era marked by financial volatility and uncertainty, investors are increasingly turning to unconventional assets to secure stability and consistent returns. Over the past three years, fine wine has emerged as an unexpected champion in wealth preservation. It has demonstrated resilience and outperformed traditional options like the S&P 500 and gold during economic turbulence.

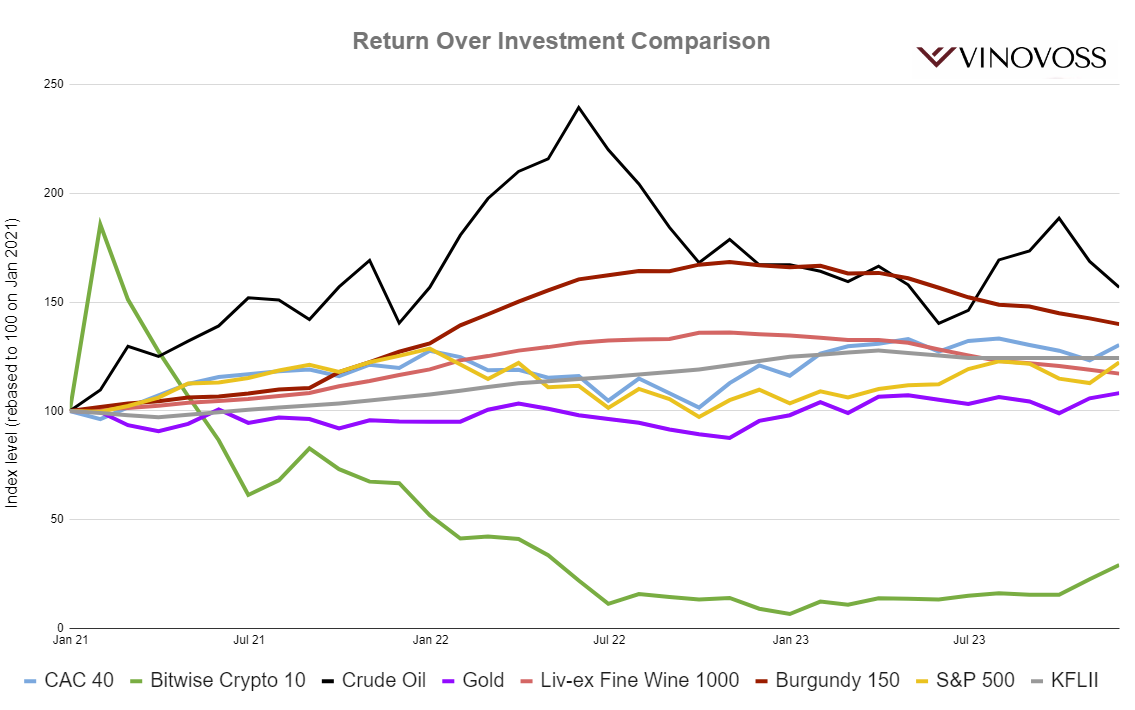

We compared the Return on Investment (ROI) of 8 investments during the last 3 years. The following indexes were included: S&P500, CAC40, crude oil, gold, Bitwise Crypto 10, Knight Frank Luxury Investment Index (KFLII), Liv-ex Fine Wine 1000, and Liv-ex Burgundy 150 index.

Return Over Investment Comparison: fine wine, crypto, luxury, gold and S&P 500 index (Chart created by Krystal Wen, Data Sources: Liv-ex, investing.com, knightfrank.com)

Major Market Trends and Performances

From March 2022 onward, major Western financial markets, including the S&P 500 and CAC 40, experienced significant declines. Concerns and speculations surrounding the global rate hiking cycle have led to these declines. The S&P 500 hit a two-year bottom in September 2022, only beginning to recover thereafter.

Resilience of Fine Wine and Luxury Markets

While traditional financial markets showed bearish signs, both the fine wine and luxury markets exhibited strong resilience. The Liv-ex Fine Wine 1000 Index peaked in October 2022, led by the outstanding performance of Champagne and Burgundy. Simultaneously, the luxury market, as indicated by the Knight Frank Luxury Investment Index (KFLII), experienced a two-year upward trend, reaching its peak in March 2023.

Impact of Global Events

Amidst global events such as the Russia-Ukraine war, crude oil prices skyrocketed to a three-year high in May 2022. Despite subsequent fluctuations, the prices maintained a remarkable 57% three-year growth. This underscores the impact of geopolitical events on traditional financial instruments and emphasizes the need for diversified investments.

Cryptocurrency Volatility

Bitcoin, once a stronghold of investment, experienced a significant downturn until January 2021. The Bitwise Crypto 10 Index plummeted by 179% in 23 months before finally showing signs of recovery. Over the past three months, the Bitcoin market demonstrated a stronger rate of growth, despite a 3-year decrease of 77%. This highlights the inherent volatility of cryptocurrencies and the importance of carefully navigating this space.

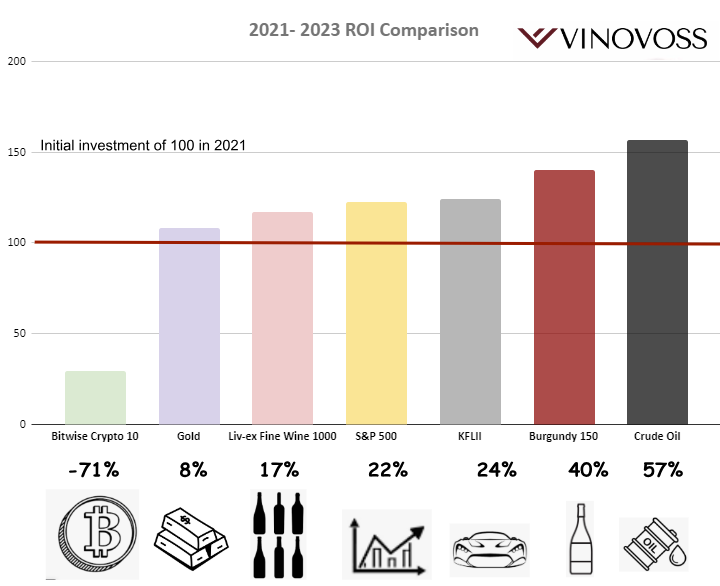

ROI Comparison of different investments - with an initial investment of 100 in 2023 - crude oil, Burgundy fine wine and luxury goods (KFLII) has the highest 3-year ROI (Chart created by Krystal Wen, Data Sources: Liv-ex, investing.com, knightfrank.com)

Benefits of Investing in Fine Wine

In conclusion, the financial landscape of the past three years has been tumultuous. As a result, traditional markets have been experiencing significant fluctuations. Fine wine has outperformed conventional investment options during these times of economic uncertainty.

It has emerged as a beacon of stability and consistent growth. As investors seek refuge from market volatility, diversifying portfolios to include resilient assets like fine wine becomes increasingly crucial.

2024 has found a world where geopolitical events and financial market dynamics can rapidly change. In such an environment, the intrinsic qualities of an investment, such as fine wine and luxury goods, shine through. They are a tangible, appreciating asset, offering a compelling option for astute investors.

Next week, we will examine the relationships between these assets. We will then examine which ones are more suitable for portfolio diversification.

Stay tuned.

By Krystal Wen

This article has educational purposes and must not be considered financial advice.

Latest articles